Yellow Springs Schools—

2021 school tax levy calculator

On Tuesday, Nov. 2, residents of the Yellow Springs Exempted School District will vote on a combined property tax/income tax levy of 6.5 mills/0.50 percent, which is designed to raise $35.6 million to construct a new K–12 school at the current site of the middle/high school campus on East Enon Road. If the levy passes, the new tax rates would take effect in 2022.

The bond levy expires after 37 years; the income tax would be ongoing. If the district receives reimbursement from the state, which is estimated to take 10 years, property tax contributions may decline.

This calculator was created to help residents estimate what the levy might cost their household. It is for educational purposes only, and provides a rough estimate that may not reflect actual taxes. None of the information input into the calculator is collected or stored by the Yellow Springs News.

To proceed, you will need two figures: 1) Your appraised* property value, and 2) your household’s annual school district taxable Income.*

If you do not own your residence or earn income, simply leave those fields blank.

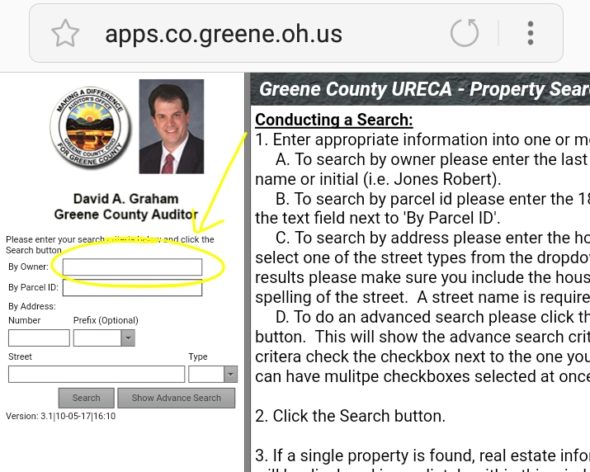

To find your appraised* property value, visit the following site: https://apps.greenecountyohio.gov/auditor/ureca/default.aspx

* In response to observations we received about the proper field data and wording, the News has adjusted the form accordingly.

2021 School Levy Calculator

Using the Greene County Auditor website

The easiest way to find your property is to use the property owner’s last name. Note: if you own the property with another person, you may need to search with their last name, as only one deed holder is searchable per property.

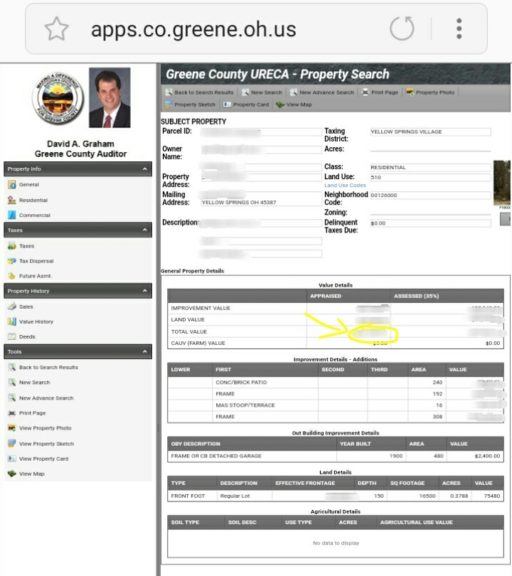

The search result will show a list of properties. After selecting and then clicking on the property associated with your household, you will see the following screen:

• Click here to return to the calculator.

You can find your appraised home value in the section “General Property Details” in the third row down of the second column.

Appraised value should not be confused with market value or the price you bought your home for. Appraised value is usually at least 5 percent less than market value, according to Greene County Auditor David Graham, and can be significantly less.

School district taxable income is the same as state taxable income and can be found on line 5 of the Ohio tax form IT 1040. According to the Ohio Department of Taxation:

Income that is not taxed: Social security benefits; disability and survivor benefits; railroad retirement benefits; welfare benefits; child support; property received as a gift, bequest or inheritance; and workers’ compensation benefits.

Income that is taxed: wages; salaries; tips; interest; dividends; unemployment compensation; self-employment to the extent included in OAGI; taxable scholarships and fellowships; pensions; annuities; IRA distributions; capital gains; state and local bond interest (except that paid by Ohio governments); federal bond interest exempt from federal tax but subject to state tax; alimony received; and all other sources.

• Click here to return to the calculator.

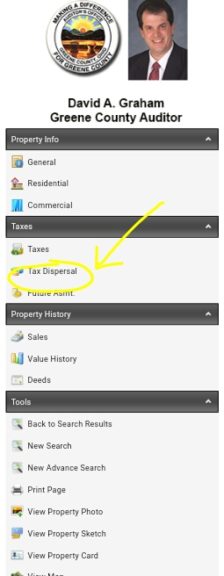

To view your current property tax totals and sources, select “Tax Dispersal” in the left-hand column at your property’s page.

Recent Comments